Let us go back to our butter example and add some Government flavor to it. If you are not familiar with the typical sections of an Request for Proposal (RFP) now would be a good time to take a quick aside at say, here.

I am making cookies therefore I need to acquire one stick of butter (Section C)

Your proposal should include the name of the manufacturer of the butter, the package size, the source animal of the butter, your process to make the butter, at least one past performance reference, and the price (Section L).

The award will be made on a best-value tradeoff basis, considering technical capability, past performance, and price. Technical capability is significantly more important than Past Performance, and when combined the non-price factors are significantly more important than price. Each non-price factor will be assigned an adjectival rating of: Outstanding, Good, Acceptable, Marginal, or Unacceptable (Section M).

So how do we transform this into our PTW window? You could plot the adjectival ratings themselves on the X axis but due to different weightings its best to convert the qualitative into the quantitative.

Capability (Score)

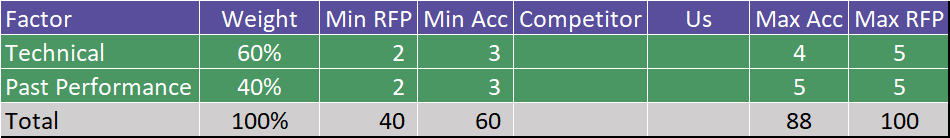

First, tech is significantly more important than past performance. This is where some of the subjectivity comes in to play. Is that relationship 90/10, 80/20, 70/30, or 60/40? It is a trick question because there is not a right answer. The answer is whatever your perception of that relation is given what you know about the client’s preferences. Those preferences may be hinted at in the solicitation and/or made verbally in advance of the solicitation. In this case let us say that we know the client cares most about the quality of the butter, but has also mentioned by name their desire to use a vendor who has a history of delivering the product successfully. Well that preference doesn’t sound as extreme as a 90/10 or 80/20. It kind of sounds more like a 60/40, for our approach that is what we will go with.

Next, what are the possible scores? There are five adjectival ratings so we will assign them 1-5 with 5 being the highest rating. Could you assign them 0-4 or 0-100 in 20 point increments? Sure you could. But 1-5 in our opinion is more straightforward because the numbers are smaller and we can (and will) scale them up later.

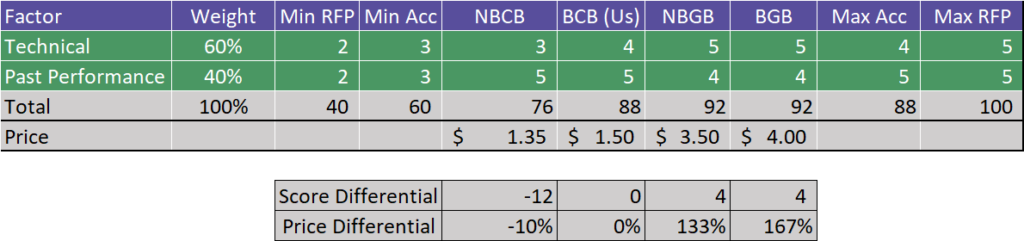

Now we can start to build a table (best done in Excel). In order to be able to compare our analyses between bids, and over time to hopefully improve our estimating skills, we scale the final score to 100. The math then is:

- for each factor, for each company: factor weight in % * (Score / Max Score) * 100

- for each company then sum the above for each factor to give a total score

The resulting table looks like:

Min/Max RFP – Normally the min/max score possible based on how we quantified the RFP

Min Acceptable – We chose a score of 2, instead of 1, for lowest acceptable because marginal is the lowest adjectival rating before we get to unacceptable. If say the Government used adjectival ratings that did not user the word unacceptable you would need to use your judgement to determine where to draw that line.

Max Acceptable – In this case we had inside knowledge that the client views goat butter as higher in quality than cow butter, but goat butter flavor does not come through enough in a baked cookie and thus they are less willing to pay a premium. With that we declare a 4 technical as the max acceptable by the client. This one is a little tough and is usually the max score unless there is clear enough rationale to make it something less than that.

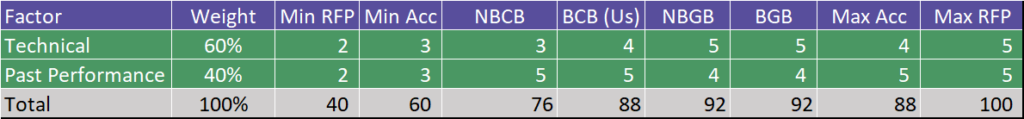

During our black hat process we identified several alternative approaches our competitors may take:

- NBCB – Non-branded cow butter at lower cost

- BCB – Branded cow butter

- NBGB – Non-branded goat butter

- BGB – Branded goat butter

The quantification of our analysis is below. Note that during the early capture discussion we decided to use a Branded Cow Butter (BCB) approach based on our perception of the clients desires and the competition. We also ascertained that there are no other competitors able to provide a BCB product, but that there is the possibility that the other approaches are in play.

Why we ranked things the way we did:

- Technical:

- The client favors the demonstrable higher quality with brand name so an unbranded butter is acceptable (3) but not ‘good’ worthy (4)

- The client sees goat butter as the highest quality but sees no difference between branded/unbranded goat butter, thus both get a 5

- Because we know the client is aware that goat butter is of higher quality than cow butter their scores are 5 and 4 respectively.

- Past Performance:

- The vendors providing cow butter have already provided the exact size and scope of the product to the Government before, and thus we believe they will achieve an exceptional (5) past performance rating.

- The vendors providing goat butter have provided it to the Government before but not the same size and scope so we believe they will not get Exceptional (5) but could get a Good (4).

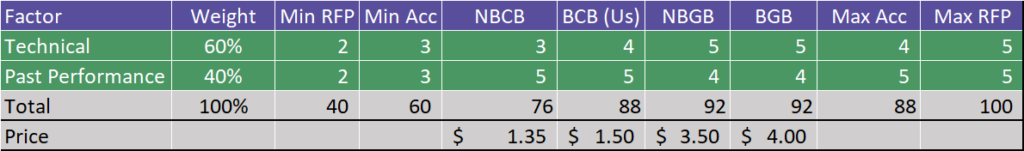

Price

We have done our research on the prices of the various products so we add them to the table and plot them on our PTW Window.

Price to Win

Now we have all the right pieces to compute the price/score differentials from our solution.

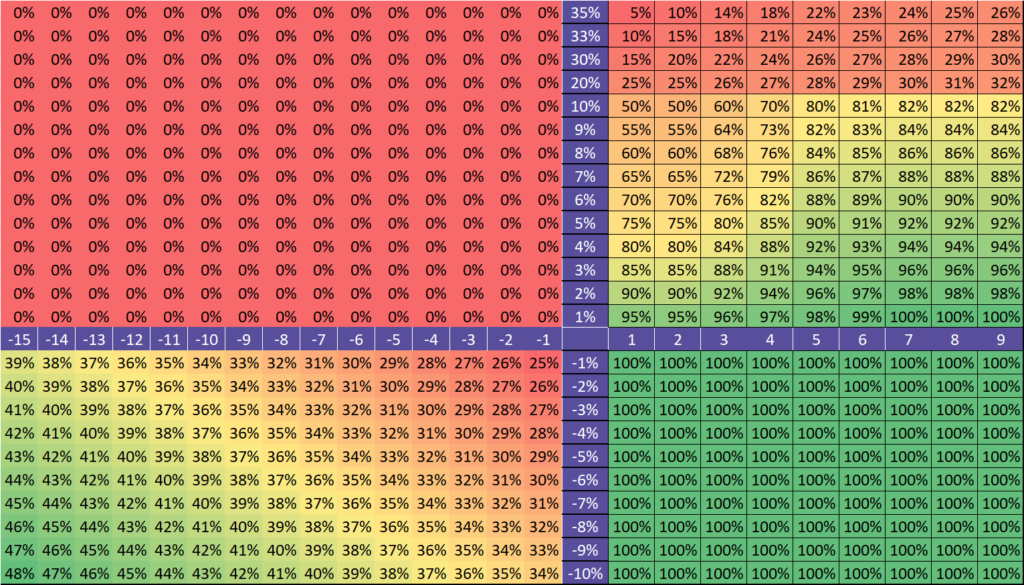

Here is where we bring in the GovPTW tool. We take a look at a couple areas of the tool that are pertinent to the differentials we see in our analysis.

Keep in mind these are notional values from our tool (lots of free advice here but no free lunch 🙂 ).

Armed with this data, we are now able to make some informed decisions.

- Leading Goat Based Products (NBGB/BGB) – these have two issues with them that are in our favor:

- They are both above our understanding of the client’s max budget and our ICE stand in for the IGCE

- At only 4 points higher in capability and an at least 33% price premium, they at best have a pWin of 21%

- Trailing Non-Branded Cow Based Product (NBCB) – this one we need to be a little more careful about, at 12 points lower than our score and a 10% discount it has a pWin of 45%, if that is too high of a pWin for our risk appetite then we can lower our price, closing the gap and increasing our pWin

Our recommended Price to Win is our current price of $1.50. In this case that is not an accident as we clearly had some inside knowledge of the client’s needs and preferences, we were not worried about our higher quality competition due mostly to their price, and we did not waiver with the pWin of our cheaper competitor.

Next, we put this analysis into a brief-able format and go have a discussion with leadership. If we were doing this pre-RFP during the blue/black review (and make some assumptions about what the RFP would say) then we have time to change our approach. However, if we are having this discussion during or after red team, sadly it is likely too late to make any significant changes that do not cost us time we probably do not have and/or additional costs and risk to the proposal.

The GovPTW GAO protest based product allowed us to quantify the pWin differences of our competition and then make an informed risk/reward decision, arriving at and confirming our final price.